The influential Treasury Committee has told the Government it must cut interest rates, reintroduce maintenance grants and offer more help to part-time students, Aban Contractor reports.

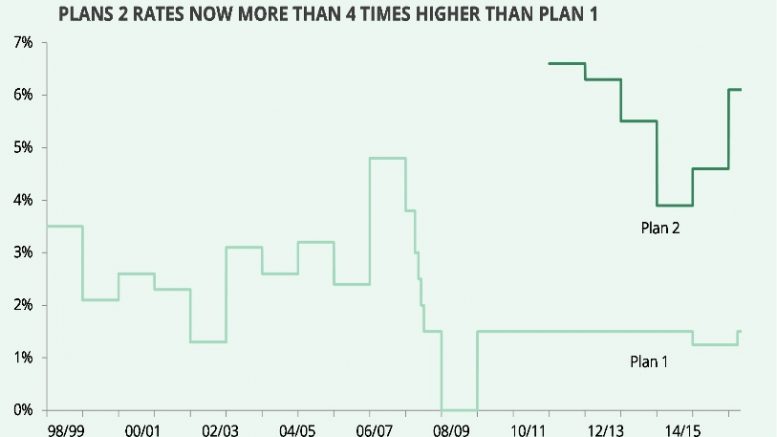

The push by government to hit students with high interest rates on university and college loans must be re-examined as a matter of priority, an influential cross-party parliamentary committee said today.

The House of Commons Treasury Committee said policy makers needed to look again at the above-inflation rate on tuition fee loans while students were still studying and assess the case for the reintroduction of maintenance grants.

Student Loans, a 49-page report, also said that a fundamental rethink of financial support for part-time students was warranted after the number of part-time students fell by 47 per cent, from 590,000 to just over 310,000 after government changes to university funding were introduced in 2012.

Between £6bn-£7bn on annual student loan write-offs were hidden from the deficit and more than £6bn could be written off through the sale of £12bn of student loans over the next five years, the report concluded.

‘No other persuasive explanation has been provided for why student loan interest rates should exceed those prevailing in the market, the Government’s own cost of borrowing, and the rate of inflation. The Government must reconsider the use of high interest rates on student loans as part of its review’

Alistair Jarvis, chief executive of Universities UK (UUK) – whose members are the vice-chancellors or principals of UK universities – said the system needed to be better understood and to feel fairer to students.

“More should be done to address students’ concerns about living costs so that no-one is deterred from benefiting from a university education,” he said.

“New investment to re-introduce maintenance grants for the poorest students would be a positive step.”

Sally Hunt, the general secretary of the University and College Union (UCU) – which represents university staff – said any review of student funding must be radical and explore genuine alternatives to the current system.

“The current student finance system is broken and, at the moment, it doesn’t look like this review is going to fix it,” Ms Hunt told Chief-Exec.com.

“Looking at flexible course fees and two-year degrees is a distraction from the fundamental problem – that students are taking on hefty debts to study while business gets off the hook on paying for the graduates it needs.

“If the Government really wants to ensure that higher education works for students and taxpayers, it needs to be bolder and look at genuine alternatives to the current tuition fee system which focus on education as a public good.”

Nicky Morgan, Conservative MP and Chair of the Treasury Committee, said the Government had argued that the interest rates on student loans were progressive.

“But the Committee remains unconvinced as high-flying graduates may pay less than graduates on more modest earnings,” she said.

“No other persuasive explanation has been provided for why student loan interest rates should exceed those prevailing in the market, the Government’s own cost of borrowing, and the rate of inflation. The Government must reconsider the use of high interest rates on student loans as part of its review [into student funding announced in October last year].

“The Government should also consider how to simplify the student loan system to ensure that student finance is more understandable, and why a tuition fee rate higher than it expected is desirable.”

Prime Minister Theresa May is expected tomorrow to reveal details of a tuition fee overhaul, according to The Guardian. Options being considered include cutting tuition fees for students in England from the current level of £9,250 to closer to 6,000 a year, by dismantling requirements on universities to spend funds on widening participation measures and bursaries aimed at disadvantaged students, the paper said.

The Treasury Committee report said that students without access to additional sources of income, such as help from their parents, could be priced out of a university education, a fact at odds with the Government’s aim of removing barriers to access. “The Government should address this by, amongst other things, assessing the case for the re-introduction of maintenance grants.”

The report said student loans were written off after 30 years. A student loan issued today would have no impact on the deficit until 2048, even though the Department for Education (DfE) recognises that a high proportion of it will never be paid back.

“This allows the Government to escape scrutiny. The DfE issued £13.6bn of student loans in 2016-17 and, based on the current RAB charge (the proportion of student debt that the Government expects to write off) of 40-45 per cent, £6bn-7bn of annual write offs are missing from the deficit – the equivalent of the entire NHS capital budget. Its inclusion would increase the deficit for 2016-17 by 13 per cent, from £45.5bn to over £51bn.

“The Government sold £3.5bn of student loans last year for £1.7 billion, a 51 per cent write off. The Government plans to sell off a further £12bn of student loans over the next five years. If the write-off rate remains the same as the previous sale, over £6bn of student loans could be written off without impacting the deficit.”

UUK’s Alistair Jarvis said: “Our universities offer a world-renowned quality of education and develop the skilled graduates our economy and society need. This can only be maintained with stable and sustainable funding, which the current system provides. The Government’s review is an opportunity to examine the evidence and to make improvements”.

UCU’s Sally Hunt said: If this review is to serve any purpose then it needs to be radical and explore genuine alternatives to the current system, not just tinker at the edges of the current failed system. Too often recent reviews have simply resulted in finding new ways to saddle students with record levels of debt”.

I am a secondary school teacher and I think it’s a grossly unfair system. Lots of my students who probably should go to uni now aren’t excited by the prospect at all. Unsurprisingly, it’s the ones from the poorest backgrounds who are the most sceptical.