If there is a powerful take-home message from last week – for chief-execs and business students alike – the succinct observations of Ray Dalio, founder of Bridgewater Associates, on “thoughtful disagreement” would be hard to beat, writes John Egan.

“Thoughtful disagreement, … that doesn’t seem to be the way most of corporate America operates,” observed Barry Ritholtz, the host of the Masters of Business podcast on Bloomberg.

“That’s our edge”, replied Mr Dalio with understated surprise as if the idea wasn’t already obvious.

It is quite an edge. One that has enabled Bridgewater to become the world’s largest hedge fund, managing more than $160 billion in assets and, according to Forbes, Bridgewater has made more money for their clients than any fund in history.

“It has been a big deal for us”, concluded Ray Dalio. So, what is thoughtful disagreement?

Ray Dalio – thoughtful disagreement [1]

The key success factor is to create a space where ideas can co-exist, co-operate and compete constructively so that you can develop the capacity to think differently from those who might represent the current market. It is equally essential to be right.

To think differently is always a risky business and discomfort is proportional to the distance one is away from the prevailing consensus. It can never be entirely eliminated, but each step to reduce risk creates value by increasing the probability of being right. It is the beating heart of entrepreneurship.

As is customary on Chief-Exec.com, we will interpret Ray Dalio’s method of thoughtful disagreement as an innovation mechanism.

Imagine an enterprise as a box with a single port of entry for its inputs – its supply chain materials and its labour and capital. If this entry port simply feeds in the external environment, the consensus is merely replicated within. Opportunities for added value creation above the background are eliminated.

The entrepreneur essentially takes the role of an infamous physics personality named Maxwell’s Demon who, if left unchecked, can willy-nilly break the second law of thermodynamics and create energy from absolutely nothing (see below).

Just as Maxwell’s Demon must eventually pay for the energy he creates by forgetting what he knows, our entrepreneur must pay for the inputs into the enterprise in a more conventional currency. Nevertheless, the role is the same, to select the people and materials with valued attributes – to incorporate independent thinking. The enterprise inputs combine within the box in an environment also conceived by the entrepreneur – in the case of Bridgewater being radically open minded and having radical transparency. An “ideas meritocracy” for value creation is born.

It is worth noting that in the above construction energy appears in the creation of valuable information. The principles apply equally for the creation of hard goods when one sees these as the embedded information that specifies the product and its means of fabrication. It is the same information that communicates a sense of the value to consumers.

Of course, when the alchemy of the enterprise has been set to work, its endeavours – derived from the ability to think differently – must be valuable to the outside world. They must create a new consensus. When the differences exposed through thoughtful disagreement have been reconciled to raise the probabilities of getting at the best answer, the collective intuition of those who do the thinking must have the best chance of being right. The risk of failure is reduced.

In investment business the concept of thoughtful disagreement is especially important as it provides the means to beat the markets which, as explained by Ray Dalio, “discount the consensus”. It may well also have more universal appeal.

Maxwell’s Demon and the value of information

To state that information can be valuable is hardly controversial. Information can be extremely valuable. Knowing information that could affect a company’s stock value can lead to financial gain. High frequency trading can expedite access to this information by milliseconds, a short interval that also can be lucrative.

Information is physically encoded in many forms. Indeed, whether it is the storage of information in DNA, in computer memory or in the neural circuits of people, one can assume that information is at least, in part, formed through the organisation of some physical material.

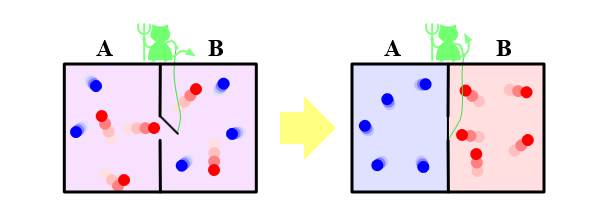

The organisation of a physical system with higher information content is associated with the system’s energy. This is most famously demonstrated by Maxwell’s Demon. In 1867 Scottish physicist James Clerk Maxwell imagined an intelligent being capable of operating a trap-door in a wall inside a closed gas-filled chamber and thereby segregating fast moving “hot” gas molecules from slow “cold” ones where normally these molecules are randomly mixed together. By making this selection the Demon can produce a machine that does mechanical work (a Szilard Engine), converting pure heat to mechanical energy. This is impossible according to the second law of thermodynamics – it suggests perpetual motion is possible and that time can reverse its direction!

It appears that to resolve this Maxwell’s Demon paradox, the intelligent Demon must identify each fast-moving molecule, operate the trap-door and then forget the information before repeating the cycle (or at least have a finite memory).

It is in the act of deleting information that energy (heat) is released and the entropy of the universe is increased to remain compatible with the laws of thermodynamics. In a more practical sense, this same concept appears in Landauer’s Principle. It has shown that the irreversible deletion of information in a computational operation must be accompanied by a dissipation of energy as heat. On the other hand, the replication of information does not necessarily require any additional energy input. Such considerations lead to a physical theory of information [2].

In the entrepreneur/enterprise version of the Maxwell Demon concept (above), the demon entrepreneur responds to information on what constitutes a valuable economic input rather than a fast-moving particle. The entrepreneur pays the monetary cost of these valued inputs as the demon pays in the energy to forget. This triage of highly valued inputs then provides the thermodynamic “edge” in the energy to drive the innovative activities of the enterprise.

Notes

[1] Full version of Ray Dalio Bloomberg – Masters in Business podcast

[2] Further explanation of the theory of information and its thermodynamic background is given by M. B. Plenio and V. Vitelli in The physics of forgetting: Landauer’s erasure principle and information theory. Contemporary Physics vol 42(1): pages 25- 60, 2001

Headline Photo Credit: Lightspring/Shutterstock.com

Maxwell Demon graphic: Htkym/Wikimedia Commons licensed under CC-BY-SA-3.0