Standing in a local shopping centre, I am thinking, “What do I know?”

It is Saturday afternoon in Meadowhall, Sheffield, in England’s north and its galleries have filled with bustling consumers weaving their way down landings with goods, discounted here and there, displayed under spotlights in shop windows.

I cannot recognise around me any of the economic agents of neoclassical economics that inhabit the standard model used for understanding and managing an economy. Their knowledge and ability to make rational choices, and choose options that offer the greatest utility seem highly idealised for this temple of commerce.

But what I can see are numerous rubber bands in the process of being stretched.

Value is perceived through a Consumer Product Interaction, but it is only when this value exceeds the set price that a sale-event will occur.

I see an alternative “microfoundation” to the neoclassical rational, self-interested individual. This new fundamental unit is not an agent with an assumed behaviour, but an event with some assumed consequences. It occurs at the very moment a consumer is made aware of a product so that they are able to bestow upon it their personal perception of value. I will call this constitutive economic event a Consumer Product Interaction (CPI).

I arrived in Meadowhall several hours earlier with a final check on a wallet stiffened by credit cards that confirmed purchases were possible. Spirits were high, encouraged by imagining the attributes of soon to be acquired goods. Jogging shoes that leak winter mud need to be replaced and give purpose to the adventure.

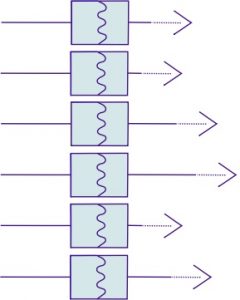

An assembly of CPI units with a varying consumer perception of value, but without the occurrence of any sale events

Thirty minutes later six sports shops had been scrutinised and analysed for the value they offer. The shelves are a battleground of the brand names – Reebok, Nike, Adidas, Umbro, Puma. Jogging shoes adorn these shelves in numbers that defy classification. A quick raster of the price tickets must suffice, together with an even quicker comparison with their alleged pre-sale recommended retail price. Jogging through Yorkshire mud must be a primary function – hence a functional and cheaper pair is selected, but alas not purchased. The available size range is less than complete. A more expensive pair with more features is similarly unavailable. All the remaining shoes now take on an identical appearance. Snow-blindness has set in and further selection is impossible.

The initial enthusiasm slowly faded and the faces of shoppers passing by suggest that this may not be a singular incidence of disappointment. In order not to completely waste the shopping expedition it is necessary to purchase something.

An assembly of CPI units with a varying consumer perception of value in which one CPI has registered a sale event

Banners proclaiming ‘30% Off’ and ‘40% Off’ now seem the dominant feature that apply to millions of unknown possibilities. Commodities move in and out of vision with barely any recognition. One item does manage to traverse the widening distance from unconscious to conscious. A perceived need for a good pair of gloves is matched to the appearance of an ideal pair hanging close by. It is a microscopic event of attraction, as if a tiny spotlight shines upon the object of desire and the rest are momentarily cast into darkness. The gloves are not even in the sale but they are purchased nonetheless.

A perusal through stacks of CDs is used to explore the opportunity for a musical adventure, but nothing is discovered to provide the necessary inspiration. Finally, a bottle of cask-conditioned ale is purchased to provide some consolation at the end of a now darkening tunnel.

In neoclassical economic analysis the individual economic agent is the epitome of self-interest, but when many are brought together and individual behaviours combine in an economic society, the multiple desires to maximise individual utility balance out and the economy is assumed to come to rest at a stable equilibrium.

Quintessentially, the alternative Consumer Product Interaction is about information transfer. This information is communicated with each CPI in order to enable a consumer to perceive the value of an associated product or service. The information may be communicated by a sales person or by an advertisement, through paper or through another media. It may be communicated by direct contact with the product itself or through some virtual equivalent. Whatever its form, the CPI is a generic moment of information transfer leading to a consumer perception of value and multiple value perceptions across a population of consumers are happening each second in Meadowhall.

On receipt of the CPI information, a consumer’s perception of value may change from a previously held opinion. A newly informed individual may register an initially high or low or zero valuation. It depends on their needs at that moment and how the utility of the product matches those needs.

Value perceptions may thus be initiated, diminished or enhanced through each CPI, but nothing of substance will happen until a specific threshold is reached. It is only when a consumer’s perception of value exceeds the price that is set for the product that a sale can occur and following which the sale price will be reimbursed to the supplier.

This everyday scenario of CPIs leading to product sales has its mechanical analogy in the physics of energy dissipative systems. The sale-events then can have a physical equivalent in the deformation of a viscoelastic material, as can be seen in the soles of jogging shoes to cushion heal-strike impacts, or in the stretching of a rubber band. In both, energy is stored in the elastic behaviour of the viscoelastic material and is also dissipated through its viscous properties. In the CPI analogy, stored energy arises from the efforts to enhance perceptions of value. Energy dissipation is analogous to miniscule fracture events that represent product sales[1].

Just as the rational, self-interested individuals of neoclassical economics combine to form a macroeconomic society, a population of CPIs combine to form a sequence of transactions through which an individual, a business unit, an enterprise or a whole market economy can be represented. It is scalable so that analysis passes from micro to macro through a continuum.

The previous Great Global Refinery sketched out some channels through which energy flows through an ecosystem. Analysis based on the CPI fundamental unit provides a means to look deeper into energy flows and transformations within its economic conduits.

We should emphasise at this point that the proposed analysis using the CPI model to simulate an economic marketplace is not in competition with neoclassical analysis, or any other approach. It essentially provides a different viewpoint and one that can be informative about the essential business practices the CPI behaviour is designed to represent.

Here we have taken a first step into an economic enquiry using an analysis that is built upon the fundamental unit of commercial exchange, namely the product sale. That such an approach can make use of an analogy with the physical sciences is nothing new – as we can see below.

Economics has always been a child of science

The rational, self-interested individualist is well known as the fundamental agent of neoclassical economics.

Perhaps less well known is that their economic behaviour is derived from the thermodynamic behaviour of chemical reagents.

Thermodynamics emerged in the first half of the 19th century and was originally used to understand the steam engine and other systems through which mechanical work could be drawn from the flow of heat from a hotter to a cooler temperature. Heat only flows from high to low temperatures and not in reverse, so thermodynamic phenomena are not reversible, making these natural analogies for irreversible economic behaviour.

Around 1875 the renowned physicist and mathematician Willard Gibbs in his publication On the Equilibrium of Heterogeneous Substances applied thermodynamic principles to chemical systems and their equilibria. The complex mathematics delayed a broad adoption of this work, which later became recognised as one of the greatest achievements of 19th century science.

In his 1947 treatise Foundations of Economic Analysis, the American economist Paul Samuelson, who interestingly had a direct intellectual lineage back to Willard Gibbs himself, recast the mathematics of thermodynamics to apply to equilibrium phenomena in the marginal supply and demand of neoclassical economics. This opened up a rich seam of mathematical formalism that greatly enhanced the reach and power of neoclassical economic theory over subsequent decades. Samuelson and several other economists became Nobel laureates as a result of these endeavours.

Samuelson begins his initial treatise with the words:

The existence of analogies between central features of various theories implies the existence of a general theory which underlies the particular theories and unifies them with respect to those central features. This fundamental principle of generalization by abstraction was enunciated by the eminent American mathematician E. H. Moore more than thirty years ago.

Mathematically the thermodynamic and economic equilibrium are both systems of constrained optimisation (on energy and utility) with a similar set of equations of state.

However, with time the enthusiasm to link the homologous mechanical and economic worlds waned and economics seemingly matured to seek its own identity. In 1960 Samuelson[2] asked:

Why should there be laws like the first or second laws of thermodynamics holding in the economic realm? Why should “utility” be literally identified with entropy, energy, or anything else? Why should a failure to make such a successful identification lead anyone to overlook or deny the mathematical isomorphism that does exist between minimum systems that arise in different disciplines?

The historical context and circumstances that led to this question are important. It could not have been asked before the development of neoclassical economics in 1947, and this could not have emerged prior to the development of its thermodynamics predecessor in 1875.

The prevailing economic (and scientific) methods today are an outcome of their genealogy.

Yet the desire to seek economics insights in the principles of mechanics has had a longer history. These had to rely on the principles of classical mechanics that predated thermodynamics.

Before 1870 the principles of classical mechanics had been developed over the previous two hundred years by Newton, Lagrange, Hamilton and Maxwell among many other luminaries. They made possible a “Marginal Revolution” in economic thought that was initiated through the independent publications of Léon Walras, William Stanley Jevons and Carl Menger. The association with the principles of classical mechanics is no more clearly demonstrated than by Walras in his 1909 final summary publication Économique et mécanique, which concludes with the following translated remarks:

In examining as carefully as one might wish the four theories given above namely, the theory of maximum satisfaction with the exchange [of commodities] and the maximum energy of a balanced beam, and also the theory of general [economic] equilibrium of the market and that of the universal equilibrium of celestial bodies, one will find between these two mechanical theories a single unique difference: the exteriority of the two mechanical phenomena and intimacy of the two economic phenomena, and thus, the ability to make everyone aware of the conditions of equilibrium of the beam and conditions of universal equilibrium of the sky, due to the existence of common measures for these physical phenomena, and the inability to demonstrate to anyone the conditions of equilibrium of the exchange and the conditions for a general equilibrium of the market, because of a lack of common measures for these psychological phenomena. We have metres and centimetres to note the length of the lever arm of the beam and grams and kilogrammes to note the supported weights. We also have instruments to determine the relative movement of stars. We are not able to measure the intensity of need between those who exchange goods. But this should be of no consequence because with each exchange, consciously or unconsciously, a person will know deep down whether his needs are satisfied or not in proportion to the value of the goods exchanged. Whether the measure be externally made or be internal, depending on whether the measurements are physical or psychological, this does not prevent the measurement itself and a comparison of quantities and quantitative relationships, and therefore as a consequence the science should be mathematical.

In examining as carefully as one might wish the four theories given above namely, the theory of maximum satisfaction with the exchange [of commodities] and the maximum energy of a balanced beam, and also the theory of general [economic] equilibrium of the market and that of the universal equilibrium of celestial bodies, one will find between these two mechanical theories a single unique difference: the exteriority of the two mechanical phenomena and intimacy of the two economic phenomena, and thus, the ability to make everyone aware of the conditions of equilibrium of the beam and conditions of universal equilibrium of the sky, due to the existence of common measures for these physical phenomena, and the inability to demonstrate to anyone the conditions of equilibrium of the exchange and the conditions for a general equilibrium of the market, because of a lack of common measures for these psychological phenomena. We have metres and centimetres to note the length of the lever arm of the beam and grams and kilogrammes to note the supported weights. We also have instruments to determine the relative movement of stars. We are not able to measure the intensity of need between those who exchange goods. But this should be of no consequence because with each exchange, consciously or unconsciously, a person will know deep down whether his needs are satisfied or not in proportion to the value of the goods exchanged. Whether the measure be externally made or be internal, depending on whether the measurements are physical or psychological, this does not prevent the measurement itself and a comparison of quantities and quantitative relationships, and therefore as a consequence the science should be mathematical.

Back still further into the second half of the 18th century the two subjects of the physical sciences and economics found themselves in particularly close proximity. Around this time, Scottish classical economist Adam Smith met Voltaire, friend and collaborator of Émilie du Châtelet who was instrumental in elucidating the nature of kinetic energy[3] and later died from complications of childbirth in the same year she had completed the first French translation of Newton’s Principia Mathematica. In this pre-revolutionary epoch, in Paris the Lumières were fermenting ideas mixing early economic concepts of the Physiocrats led by François Quesnay, with the science of Jean d’Alembert who with Diderot had recently created a new and novel Encyclopédie. Smith among many others was present and could not have remained uninfluenced by such a prestigious gathering when 10 years later he produced his seminal work – An Inquiry into the Nature and Causes of the Wealth of Nations.

We shall explore[4] the relationship between the economic analysis based upon the Consumer Product Interaction (CPI) described above and the Labour Theory of Value introduced by Adam Smith and later developed by another notable classical economist David Ricardo. This will provide an introduction for innovation that has a specific role in the creation of value perceived through the CPI.

It is the impact of innovation that can provide a measure of “the intensity of need between those who exchange goods” as sought by Léon Walras.

Notes

[1] This requires the equivalence of continuous “spring-dashpot” viscoelastic model with a stochastic alternative that replaces the dashpot with a micro-fracture element. This equivalence has been established by the author in: A New Look at Linear Viscoelasticity, Materials Letters 31 (1997) 351-357

[2] As quoted by Eric Smith and Duncan K Foley in Classical thermodynamics and economic general equilibrium theory. Journal of Economic Dynamics & Control 32 (2008) 7–65. This paper gives an interesting analysis of some important fundamental differences between the thermodynamic and economic analyses.

[3] Establishing that kinetic energy is ½mv2 where m is the mass and v the velocity of a moving body.

[4] This approach which assumes labour has two components, innovation for value creation and production for value replication, has previously been published in A Labour Theory of Value Creation.

Follow on twitter: @johnmegan