The number 66 has iconic status in automotive circles, evoking the spirit of freedom and expansion along America’s most famous highway. While Route 66 shot long and straight across the US, Britain’s carmakers have always had more winding roads to navigate.

Although last month’s new 66 registration plate would have enticed buyers into showrooms, carmakers are putting more faith in safety improvements and alternative fuels to drive sales amid uncertainty over negotiations to leave the European Union.

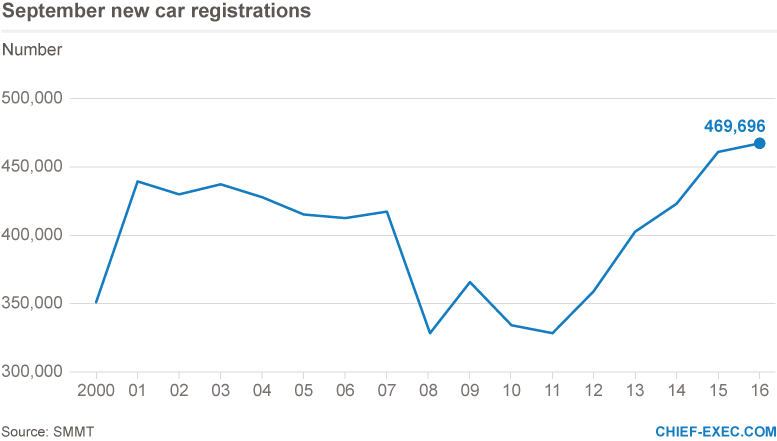

The spectre of a hard Brexit threatens to put the skids on growth in UK car sales – even though September saw record registrations of 469,696, a rise of 1.6 per cent on the same month last year. Total vehicle sales for the year to date were 2,150,495 – a rise of 2.6 per cent on last year, according to the Society of Motor Manufacturers and Traders. Although petrol cars took a dip last month – down 1.1 per cent – sales of alternative fuel vehicles surged by 32.6 per cent to 16,060.

However, over the past six months private sales have declined steadily as buyers turn to nearly-new cars amid a reduction in subsidised finance offers. And with a review of company cars underway by the UK tax authorities (HMRC), the business market is likely to feel the pinch, too.

Renault-Nissan’s chief, Carlos Ghosn, has said the company will not invest further in its Sunderland plant until the UK government agrees to compensation for additional taxes it might incur as result of Brexit.

“If there are tax barriers being established on cars, you have to have a commitment for carmakers who export to Europe that there is some kind of compensation,” said Mr Ghosn at the Paris motor show. The plant employs 7,000 people and accounts for a third of Britain’s car exports.

Ford, Vauxhall, Honda and Suzuki were quick to follow Peugeot-Citroen in raising UK prices this month, but without any material changes yet in place, such moves might well be viewed cynically. But with sterling’s near 5 per cent drop last week, manufacturers – not least car groups – will have more reasons to seek recompense for Britain’s bumpy economy, notwithstanding the additional profits accrued by the likes of Renault-Nissan since June 22, from exports to the eurozone, amid a weakening British currency.

They will not be assured by comments from French president François Hollande last week, who joined calls for a hard Brexit. “The UK has decided to do a Brexit, I believe even a hard Brexit. Well, then we must go all the way through the UK’s willingness to leave the EU. We have to have this firmness. If not, we would jeopardise the fundamental principles of the EU. Other countries would want to leave the EU to get the supposed advantages without the obligations.”

As if it was not a slippery enough slope, drivers will face higher forecourt prices because the UK is a net oil importer and the price of crude is going up.

Though data is still scarce on the effects of Brexit, industrial production was worse than expected in August, and prime minister Theresa May underlined her commitment to a divorce by pushing for a March deadline to trigger Article 50, formally leaving the EU, at the Conservative party conference. The chorus of harsh rhetoric from her European contemporaries has only added to the gloom – and sent renewed jitters through global markets.

British drivers had better keep their eyes on the road ahead.

By James Fitzgerald