About £36 billion in taxes were not collected, avoided or evaded last financial year, according to a report produced by HM Revenue & Customs.

However, the “tax gap” – the difference between the amount of tax that could be collected by HMRC against what is actually collected – had fallen from 6.9 per cent to 6.5 per cent.

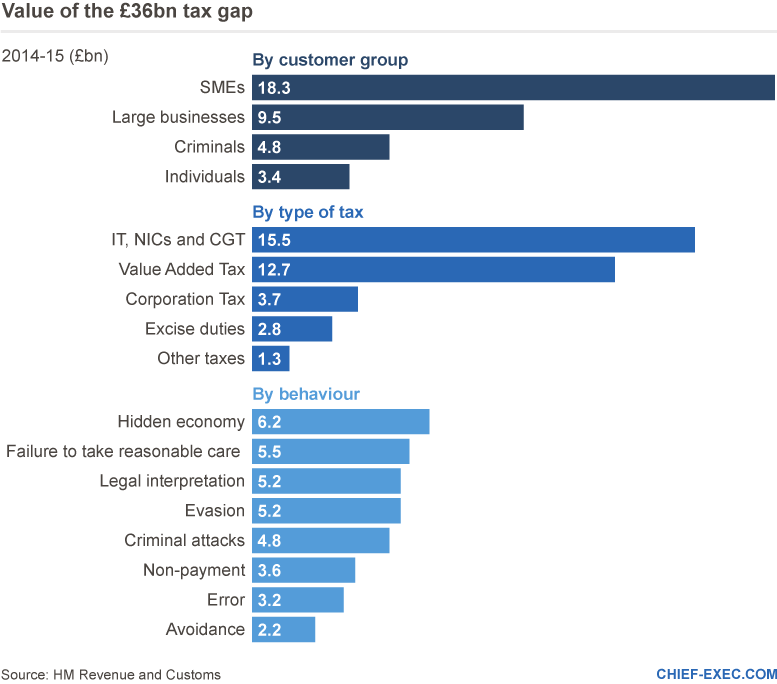

In the 2014-15 financial year, the value of the tax gap by “customer group” was SMEs £18.3bn, large businesses £9.5bn, criminals £4.8bn and individuals £3.4bn, according to the 85-page report, Measuring tax gaps 2016 edition.

The Public and Commercial Services (PCS) union said the amount of revenue lost was closer to £100bn, rather than £36bn, and called on the government to shelve plans to close more than 100 offices across the UK, with the loss of thousands of jobs.

The PCS general secretary, Mark Serwotka, told Chief-Exec.com yesterday that since 2010 about 10,000 jobs had been cut from HMRC and the department planned to cut another 10,000 staff by 2021.

“The fact that the tax gap remains persistently high – even by HMRC’s own estimate – shows that there aren’t enough staff in compliance [roles] and, rather than just remaining stable, the department should employ more and direct them more effectively,” he said.

Mr Serwotka said the government must invest in HMRC if it is serious about tackling tax avoidance and evasion.

“Instead the Tories continue to cut its budget, leading to office closures and job losses,” he said. “Staff at HMRC work incredibly hard collecting and administering the taxes that fund the other public services we all rely on every day of the week.”

A spokesman for HMRC said the department had too many expensive, isolated and outdated offices which made it difficult to collaborate, modernise ways of working, and make the changes needed to transform its service to meet customer needs and clamp down further on the minority who tried to cheat the system.

“The new regional centres will bring our staff together in more modern and cost-effective buildings in areas with lower rents,” he said.

“They will also make a big contribution to the cities where they are based, providing high-quality, skilled jobs and supporting the Government’s commitment for a national recovery that benefits all parts of the UK.”

The spokesman said HMRC had been relentless in its crackdown on tax evasion and avoidance, taking action to prevent such behaviour at the outset, and to detect and counter it effectively where it persisted. During the last Parliament, HMRC secured £100bn in additional compliance revenue as a result of actions taken to tackle evasion, avoidance and non-compliance, he said.

The HMRC report said that over the past 10 years the tax gap had closed from 8.3 per cent to 6.5 per cent.

“The tax gap estimate of £36bn is £11bn lower than it would have been if the percentage tax gap had remained at the 2005-06 level of 8.3 per cent,” it said.

“Just over half of the 2014-15 tax gap can be attributed to small and medium-sized enterprises, known as SMEs, and just over a quarter from large businesses. The remainder is split between criminals and individuals.

“…Organised criminal gangs undertake co-ordinated and systematic attacks on the tax system. This includes smuggling goods such as alcohol or tobacco, VAT (value added tax) repayment fraud and VAT Missing Trader Intra-Community (MTIC) fraud.”

By Aban Contractor

Be the first to comment on "£36bn in missing taxes"